Platform

Platform

LATEST PLATFORM EDITION

![]()

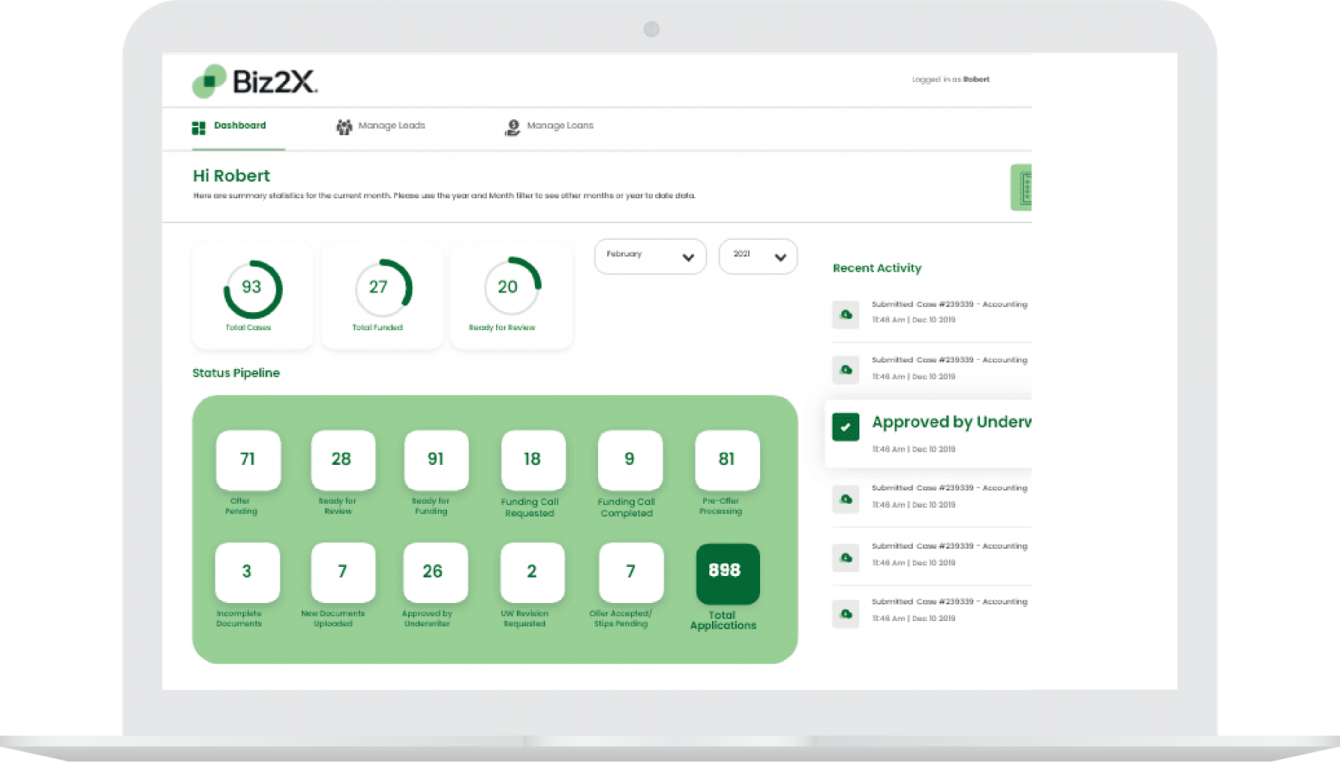

The Ascend edition of Biz2X offers an improved platform interface with a smart dashboard that flags key information, includes the latest generation of the company’s machine-learning based risk scorecard, automated lending checklist & verification view mode, and an expanded network of third-party integrations to unlock even more lending insights.

About the Platform

The Biz2X Platform offers enhanced loan management, servicing, risk analytics and a configurable customer journey, Biz2X is helping lenders run their lending operations at scale.

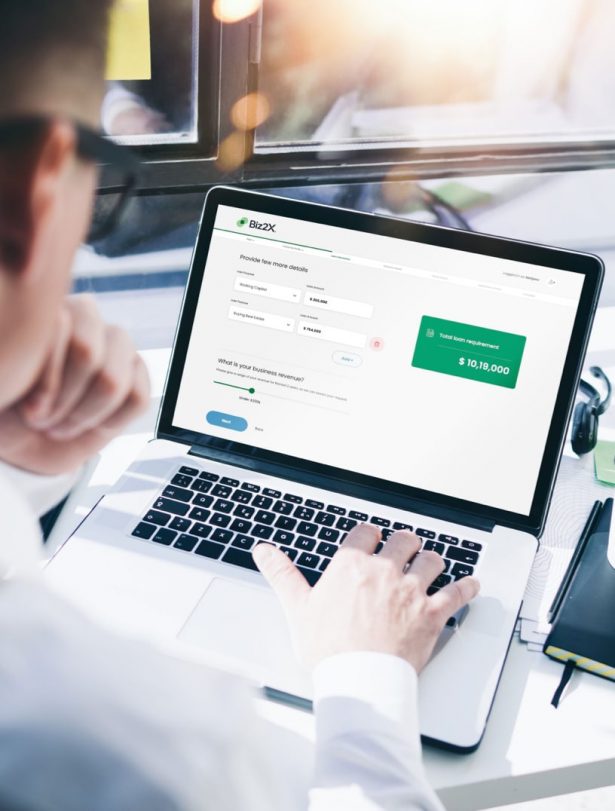

Easy-to-Use Loan Application

Banker Dashboard

Credit Analytics Tool Suite

An intelligent business lending platform with end-to-end coverage of every essential workflow and every hard-to-define process. Connecting borrowers, bankers and your business lending initiatives in one powerful platform.

Passed to Core & Servicing

Platform features

Make online business lending work for your brand with the Biz2X loan application experience customized to your branding.

Serve customers on any device or in branch, with an omni-channel digital loan application and responsive design that has been proven across hundreds of thousands of loan applications.

Built-in integrations to trusted third party data services means your customers save time while your bank can capture all KYC requirements with no extra effort. The ready-to-launch borrower portal means your customers will always know where their application stands.

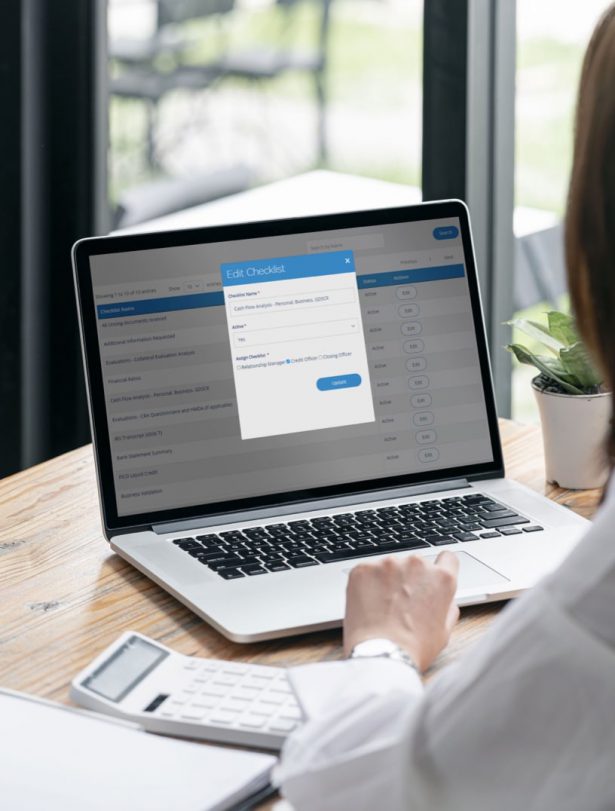

Make business lending easier for your bankers. The banker dashboard in Biz2X is an all-in-one portal for underwriting, risk and offer management, client communication and reporting.

Our platform is designed to be configured to your financial institution’s needs.

Biz2X will match your credit policies, giving you precise control over configurable decision rules and user permissions, while equipping your bankers with automated financial calculations to cut out paperwork and accelerate loan decisions.

The comprehensive credit analytics tool suite available in Biz2X combines powerful third-party data integrations, credit analysis tools and transaction-level reports.

Implement the latest automated financial analysis techniques in your business lending workflows, so you can have confidence about every loan decision.

Dial up automated decisioning rules that fit your credit policies, or open up detailed loan-specific insights for your underwriting staff. Biz2X’s credit analytics tool suite helps your bank control risk and accelerate work all at once.

Use cases

Biz2X supports a wide range of credit and business banking solutions. The Platform has configurable modules for each kind of financing your institution offers to business clients. Read about the solutions that Biz2X supports below.

Connect with a funding platform specialist for a customized demo of Biz2X for your bank or financial institution. Schedule one-on-one time, or bring your colleagues.