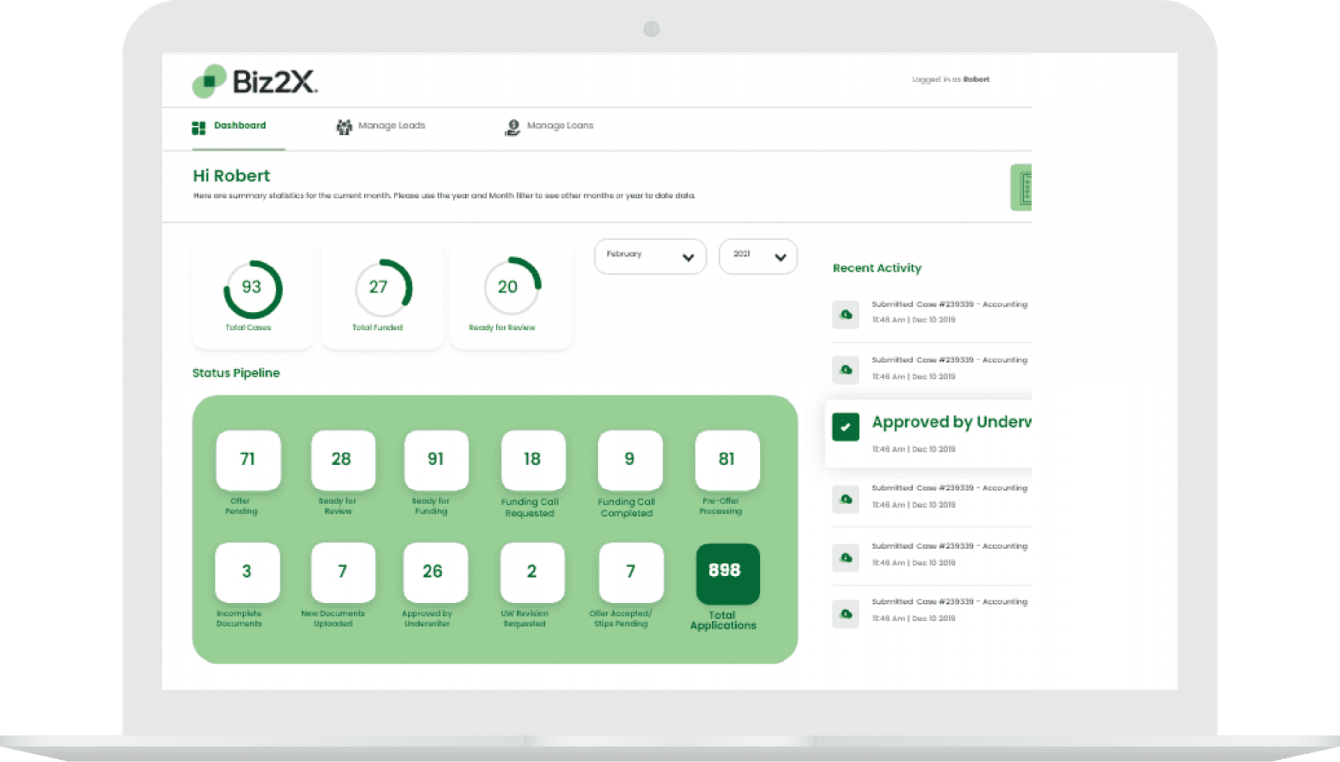

Make SBA loans work better for your small business clients with the Biz2X Accelerate SBA loan application experience customized to your institution.

Serve customers on any device or in branch, with an omnichannel digital loan application and responsive design that is tailored to the SBA lending process. Built-in integrations to trusted third-party data services means your customers save time while your bank captures all KYC requirements with no extra effort.

The ready-to-launch borrower portal brings a whole new level of simplicity and transparency to SBA lending for your clients.

Supports 7(a), Express, 504, CAPlines, Microloans & Special Programs

Accelerate SBA

Accelerate SBA