Each loan application you consider today has two charges attached to it: the credit risk associated with the borrower and the time risk incurred by your staff. In 2025, AI is catching up with both. Regional and community banks are no longer asking whether AI belongs in lending platforms and processes. They are proving AI’s value by integrating AI directly into their loan platforms. Small banks and credit unions are already piloting AI, with outcomes including reduction in loan processing time and decrease in errors.

The true benefit is the time, which can be spent on other, more important judgments that ensure margin protection and build up client trust with underwriters. That is why the largest institutions are doubling down on their efforts. One such initiative is at Bank of America, which plans to allocate $4 billion of its 2025 technology budget to AI-based processes, aiming to make workflows more efficient and enhance customer and employee experiences. In the case of community and regional financial institutions, where every resource is highly valuable, the potential to streamline without compromising the human touch is indeed crucial.

A 2025 Perspective on AI Agents in Lending

The lending market is at a crossroads in its business strategy. Agents are no longer an abstraction. They are becoming an integral part of a modern loan platform, reshaping how bankers interact with applications, assess risk, and guide borrowers through the application process.

Objective Impact in Real Organizations

Banks, with the help of AI-guided tools, are registering significant outcomes. The US Census Bureau’s 2025 survey findings revealed that using AI helped banks offer lower interest rates while cutting down on default rates.

To local and regional banks, these are not just metrics; they represent:

- AI improves insight visibility into borrower creditworthiness to offer competitive pricing.

- A more transparent, smoother loan platform experience for borrowers and bankers alike.

- A stronger competitive footing against both fintech and larger institutions when offering loan options.

Risk, Compliance, and Trust

Smart Lending is also made possible by the FI agents:

- They surface inconsistencies during document intake, such as missing disclosures or incomplete consent, well before the final credit approval stage.

- Predictive AI reduces operational cost, helping safeguard creditworthiness assessments and enabling Earlier interventions for at-risk borrowers.

AI, unlike many people may assume, does not just make things faster. Rather, it makes them more trustworthy and under human control in each decision.

AI Agents Pivot from Novelty to Strategy

The current year has revealed that AI agents are no longer pilots, but they are becoming the foundation:

- Nearly 70% of institutions have implemented AI-based applications, with 55% applying it to risk management and 45% to compliance processes.

- Predictive, generative, and agentic AI are quickly becoming competitive differentiators in the banking industry, with leading banks aligning their AI strategy with business objectives.

Although these figures demonstrate the industry's growth trend, they also reveal a notable gap. The majority of AI applied to lending is still focused on large-scale automation or compliance, rather than enhancing the front-line experience of underwriters and relationship managers. An AI Agent that can solve this is much needed, and Biz2X has prioritized addressing it.

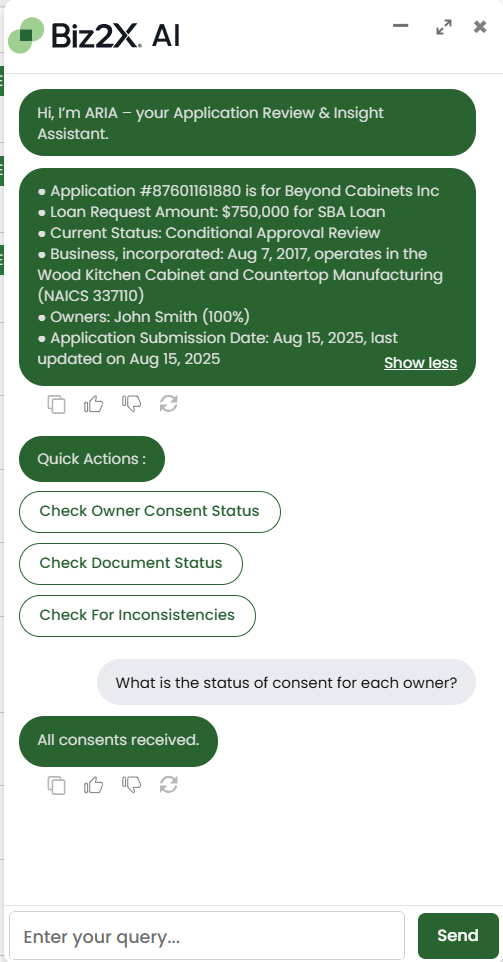

ARIA: Application Review and Insight Assistant

Built directly into the Biz2X loan platform, it is designed to support the daily work of underwriters and relationship managers with clarity, not complexity. Every capability is focused on giving bankers more control, improving the underwriting process, and making the mortgage underwriting process more transparent.

1. Borrower Snapshot: A Coherent Application Abstract

Rather than scrambling through various screens to retrieve details, ARIA provides a single-page view of the application.

- Displays the requested loan amount alongside the chosen product.

- Displays important business information, including date of incorporation, ownership, and industry of interest.

- Highlights direct equity owners, allowing bankers to view the structure at a glance.

This speeds up the application process on business loan platforms, letting bankers focus on analysis instead of data gathering.

2. Consent Tracking: Real-Time Status

Obtaining all necessary consents may take time on individual applications on a loan platform. ARIA eliminates this by:

- Showing which consents have been obtained and which are pending.

- Enabling bankers to resend consent requests at the touch of a button.

- Upon confirmation immediately once all consents are made

Clarity on the consent status reduces friction and saves staff valuable time by eliminating the need for inspections.

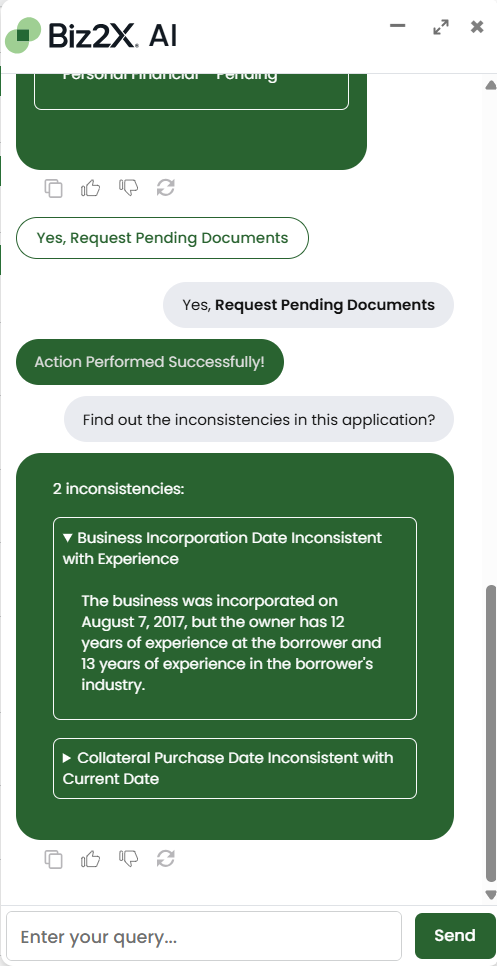

3. Document Insights: Instant Status and Quick Actions

The biggest bottleneck in lending is typically the processing of documents. ARIA transforms that with:

- Instantaneous overview of all attached documents to an application.

- Lists by ownership level, company, or individual human

- Status markers (verified, pending, or new).

- One-click document requests that automatically email applicants or owners.

This aspect eliminates the need among bankers to manually chase files and make guesses about whether a file has moved forward.

4. Inconsistency Checks: Flagging Every Red Flag

Interfering applications are frequently inconsistent in their data, and ARIA detects such inconsistencies at once.

- Provides a step-by-step account of the variance of collected data points

- Identifies areas that may require verification prior to proceeding.

- It functions like a yellow light-warns the bankers to tread slowly and cross-check.

By catching these issues early, ARIA helps improve decision quality and strengthen risk management practices.

5. Natural Language Queries: Ask a Question and Receive an Answer

The ARIA interface is designed to be user-friendly for resolving complex lending queries of underwriters and risk managers. Lenders can simply pose inquisitive questions such as:

- What inconsistencies exist within the application data?

- Does the application meet SBA eligibility criteria?

- How does the business’s cash flow compare to industry averages?

Bankers no longer need to search through tabs to find answers immediately.

Together, these features position ARIA as more than just a tool; it is a decision support system integrated into the loan platform. Bankers save time, minimize errors, and stay in control, and leaders experience faster turnaround, reduced costs, and enhanced borrower experiences. For regional and community institutions, ARIA serves as proof that AI can enhance the underwriting process and provide greater confidence in loan products such as mortgage underwriting, while strengthening the human expertise at the heart of lending.

The Unfair Advantage ARIA Offers to Regional and Small Banks

For regional and community bank leaders, lending has been a matter of striking a balance between risk, speed, and trust. Each decision you make not only influences margins but also impacts long-term customer relationships. ARIA was crafted to facilitate that equilibrium. ARIA incorporates intelligence directly into the loan platform, allowing position participants to act with increased efficiency, transparency, and certainty.

1. Increased Speed of Decision, Enhanced Relationships

Speed is an asset in the modern competitive market. Borrowers expect decisions to be made quickly, often by the next business day, and delays can prompt them to consider fintech challengers. ARIA’s real-time insights enable underwriters to approve small business requests, personal loans, and even auto loans more quickly by eliminating the need for manual checks. This means bankers can deliver timely loan offers without sacrificing accuracy.

2. Enhanced Transparency and Borrower Confidence

Customers are becoming increasingly demanding in the specifics of the borrowing process. By ensuring that critical information is more transparent, ARIA helps:

- Clear views into the loan amount, interest rate, and fixed rate options.

- Visibility into monthly payments, loan terms, and any origination fees.

- Early flagging of conditions that could trigger prepayment penalties.

This transparency not only reduces confusion but also strengthens compliance with NMLS and Member FDIC standards, building credibility with both borrowers and regulators.

3. Risk Management with Human Control

Small banks understand that it is not only about the numbers; it is about judgment. The inconsistency checks provided by ARIA safeguard the decision-makers as they anticipate potential problems prior to ultimate credit authorization. Whether it is mismatched financials, missing disclosures, or incomplete data, ARIA helps protect the bank’s reputation while maintaining full human oversight. This strengthens creditworthiness evaluations and reduces the chance of repeat hard credit inquiries.

4. Personalization Recordings that Compete with Fintech

Combatants are giant organizations and fintechs based on digital convenience. Now, regional banks are able to compete with that advantage. ARIA enables smoother borrower experiences across all loan products, from lines of credit to home improvement loans. By surfacing clear eligibility signals and delivering proactive reminders that help borrowers maintain on-time payments, ARIA directly contributes to stronger credit histories and healthier credit scores.

5. Operating Efficiency that Safeguards Profits

Margins are tight in today’s lending environment, especially as rising interest rates compress profitability. ARIA can help community banks eliminate back-office effort, allowing them to redeploy resources to more relationship-centered tasks. Lower costs, smarter pricing, and efficient processes mean more resources for growth and customer engagement, rather than wasted effort chasing documents or obtaining consents.

The Leadership Takeaway

ARIA was not developed as a generic chatbot. It’s an AI-powered lending assistant specifically designed to streamline, make more transparent, and enhance the human element of the loan platforms and mortgage underwriting processes. At regional and community institutions, ARIA enables CXOs to compete at scale without compromising the relationships and trust that community banking institutions have built.

Witness ARIA Live

Schedule a customized demo of Biz2X’s AI assistant, ARIA, and experience its game-changing capabilities live.

FAQs about ARIA’s Capabilities on a Loan Platform

1. How does ARIA improve the accuracy of applications on a loan platform?

ARIA enhances accuracy by minimizing inconsistencies and contradictions in the application review process. Within the Biz2X loan platform, underwriters can quickly identify discrepancies in borrower data, such as conflicting financial statements or missing details. This prevents delays later in the underwriting process and improves overall decision quality.

2. Can ARIA help underwriters save time in the loan platform?

Yes. The aim of ARIA is to reduce the time used by underwriters and relationship managers in conducting manual checks. By offering borrower summaries, real-time consent tracking, and instant document status updates, ARIA enhances the loan platform's efficiency. It implies that staff have more time to concentrate on judgment and building relationships, rather than being preoccupied with paperwork.

3. How does ARIA handle consent and document management in a loan platform?

Two of the most time-consuming components of lending are consent tracking and document tracking. ARIA streamlines them by indicating which consents have been received, which are outstanding, and by providing a one-click resend. For documents, the loan platform displays status by entity (business or individual) and allows bankers to request missing files with a single click. This transparency will lower the friction between the bank and the borrower.

4. Does ARIA improve compliance and transparency in the loan platform?

ARIA ensures that the loan platform highlights missing disclosures, incomplete forms, or outstanding verifications before the application reaches final review. By flagging these early, ARIA enables compliance standards and minimizes the chance of errors, which may be problematic in regulatory review. This establishes higher confidence regarding the regional banks offering financial services, from both borrowers’ and auditors' perspectives.